Capital Gains Tax in India: Types, Rates, Calculation & Exemptions (FY 2025–26)

Capital gains in India explained: holding period, tax rates, calculation formula, and exemptions for property and investments after Budget 2024 changes.

Read FullArchive of all the blogs posted

Showing 12 articles this page

Capital gains in India explained: holding period, tax rates, calculation formula, and exemptions for property and investments after Budget 2024 changes.

Read Full

Learn how Section 54F works to reduce long-term capital gains tax when you reinvest sale proceeds from non-house assets into a house in India.

Read Full

Understand how the 2024 tax changes affect share buybacks in India. Old vs new rules, impact on investors in different slabs, and what to check before tendering.

Read Full

Understand how gold investments are taxed in India - from jewellery and coins to ETFs, mutual funds, and Sovereign Gold Bonds. Learn capital-gains rules, holding periods, and ways to save tax under Se

Read Full

Clear guide to mutual fund taxation in India for FY 2025–26 after July 2024 changes: equity STCG 20%, LTCG 12.5% with ₹1.25L exemption, debt/hybrid rules, dividends, examples, tables, and FAQs.

Read Full

Section 44ADA explained - who’s eligible, ₹75 L digital-receipts limit, 50% deemed profit, advance tax by 15 March, ITR-4 rules, and real examples.

Read Full

Avoid common errors while claiming HRA in FY 2024–25. Learn 7 key mistakes salaried employees make, documents needed, and how to choose the right tax regime for HRA benefits.

Read Full

Learn what tax planning means, why it’s important, and how to save income tax legally in India using deductions, exemptions, and smart investments.

Read Full

Plan taxes smartly in 2026! Compare old vs. new regime, learn deductions under 80C, 80D, 80E, and save more legally. Updated slabs and deadlines inside.

Read Full

HUF means Hindu Undivided Family. Learn how it works, who can form it, its tax benefits, PAN card process, and how to legally save tax via HUF.

Read Full

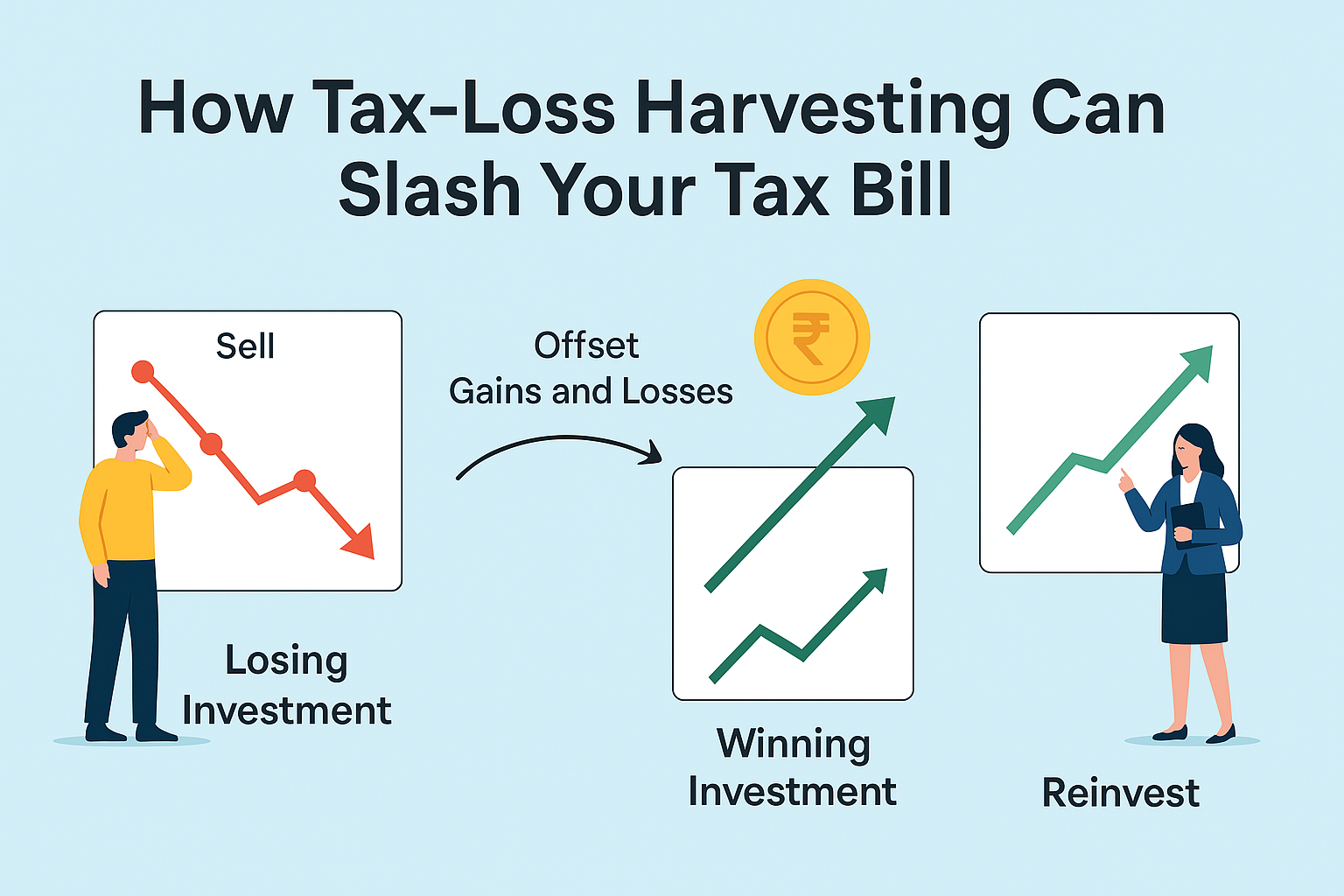

Learn how tax-loss harvesting helps Indian investors reduce capital gains tax by selling loss-making assets. Simple, legal, and easy-to-understand strategy.

Read Full

Curious how much your EPF savings can grow by retirement? Explore 3 real-world scenarios that show how different incomes and timelines affect your final EPF corpus.

Read Full