Which ITR Form Should You File in India? ITR-1 to ITR-7 Explained

Confused about ITR-1, ITR-2, ITR-3, ITR-4 or others? This guide explains which ITR form to...

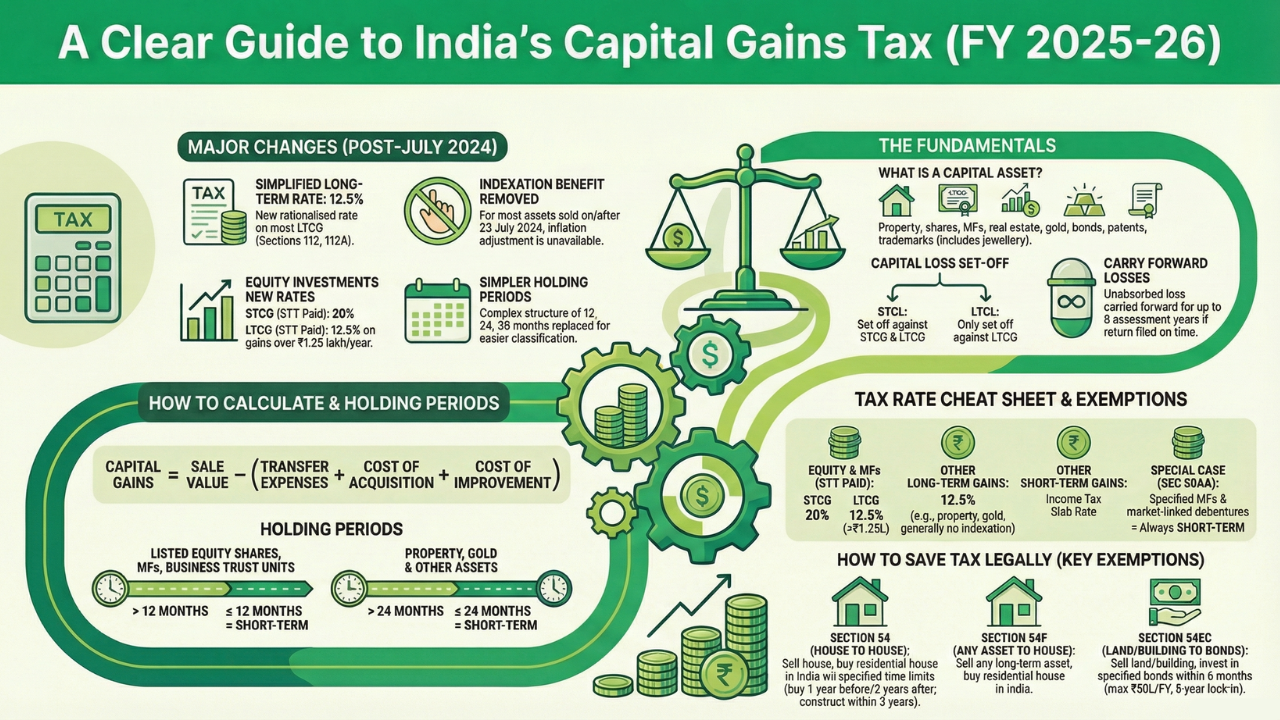

From 23 July 2024, capital gains tax became simpler in three big ways:

Also, for STT-covered equity cases, the concessional STCG rate under Section 111A moved to 20%, and LTCG under Section 112A moved to 12.5%, with the exemption threshold increased to ₹1.25 lakh.

You pay capital gains tax when you sell a capital asset for a profit. Capital assets include things like property, shares, mutual fund units, gold, bonds, and even intangible assets like trademarks and patents.

Some items are kept outside “capital asset” rules, typically personal-use items. But one common confusion matters:

If you sell below your purchase price, you have a capital loss. Tax is generally computed on net gains after set-off rules:

These are standard Income Tax Department rules.

Start here, always:

Then classify it as STCG or LTCG based on holding period, and apply the right tax rate.

In simple terms, many assets now fall into one of these buckets.

| Asset type (common cases) | LTCG if held for more than | STCG if held for |

|---|---|---|

| Listed equity shares, equity mutual funds, units of business trust (STT conditions apply) | 12 months | Up to 12 months |

| Many other assets like property, gold (and several non-equity assets) | 24 months | Up to 24 months |

Quick note: There are edge cases by instrument type (listed vs unlisted, special instruments). If your asset is unusual, verify the exact holding-period rule before filing.

Post 23 July 2024, these are the most-used rates most taxpayers deal with:

Remember: final tax payable can include surcharge and cess depending on your income and filing situation.

Some instruments are treated differently even if you hold them for years.

Under Section 50AA, gains from:

can be treated as short-term capital gains irrespective of holding period. In plain English, you lose the “wait long-term, get LTCG treatment” benefit for these.

These are the exemptions people search for most. They matter mainly for property and large long-term gains.

Practical heads-up: The Income Tax Department also reflects caps and conditions for exemptions (example: limits around very large investments under Section 54/54F).

You invested ₹5,00,000 in an equity mutual fund and sold it later for ₹7,50,000 after more than 12 months.

Rate and threshold are per official FAQs.

You sell a long-term plot for ₹90,00,000. After transfer expenses, your LTCG works out to ₹30,00,000.

This year, you have:

Set-off logic:

These set-off rules are per Income Tax Department FAQs/tutorials.

Classify the asset correctly, compute gains with the basic formula, apply the right rate (111A, 112A, 112, or 50AA), then check if Section 54, 54F, or 54EC fits your case.

No. Many LTCG cases moved to 12.5%, but STCG can still be 20% (111A) or slab rate depending on the asset.

For many transfers on/after 23 July 2024, official guidance states indexation is not available under the rationalised regime.

The ₹1.25 lakh threshold is specifically highlighted for Section 112A equity-style LTCG cases.

No. Capital losses are set off only against capital gains, subject to rules.

Typically up to 8 assessment years, subject to return filing rules.

Not necessarily. Some funds can fall under the Section 50AA “specified mutual fund” definition where gains are treated as short-term irrespective of holding period.

Section 54 allows purchase within 1 year before the date of transfer, or within 2 years after, or construction within 3 years, subject to conditions.

In practice, the cap is commonly reflected as ₹50 lakh per financial year, and issuers also show this limit on their product pages.

Disclaimer: This content is for education. Tax outcomes depend on facts, dates, and instrument type. Use official Income Tax Department guidance and your return-filing context for final decisions.

Finnovate is a SEBI-registered financial planning firm that helps professionals bring structure and purpose to their money. Over 3,500+ families have trusted our disciplined process to plan their goals - safely, surely, and swiftly.

Our team constantly tracks market trends, policy changes, and investment opportunities like the ones featured in this Weekly Capsule - to help you make informed, confident financial decisions.

Learn more about our approach and how we work with you:

Popular now

Learn how to easily download your NSDL CAS Statement in PDF format with our step-by-step g...

Explore what Specialised Investment Funds (SIFs) are, their benefits, taxation, minimum in...

Learn How to Download Your CDSL CAS Statement with our step-by-step guide. Easy instructio...

Looking for the best financial freedom books? Here’s a handpicked 2026 reading list with...