Budget 2026 STT Hike Explained: Impact on F&O Trades in India

Budget 2026 raises STT on futures and options from April 1, 2026. See new rates, rupee imp...

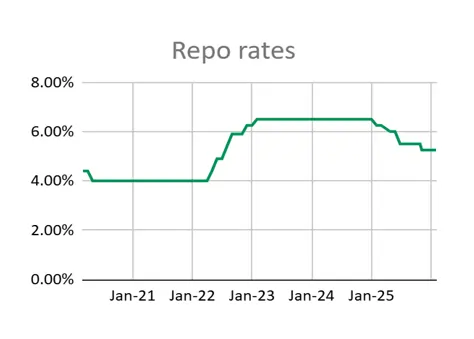

RBI kept the repo rate unchanged at 5.25%. That was expected.

What mattered more were the small upgrades inside the inflation projections and a near-term data change that could make inflation prints look higher even if your day-to-day prices do not change much.

Here’s the MPC outcome, plus what it could mean for borrowers, savers, and markets.

Policy decision

In simple, RBI has paused after a fairly aggressive easing cycle, and it now wants earlier moves to transmit fully into the system.

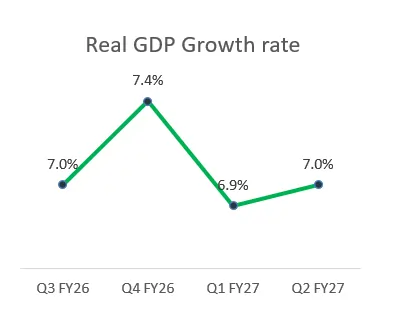

RBI’s growth projection for FY26 real GDP is 7.4% YoY. The policy commentary also points to private consumption as a key driver.

The message is straightforward: growth looks okay, so RBI can afford to wait and watch inflation signals before doing anything further.

India’s headline CPI has stayed muted. December printed at 1.3%, and inflation has remained under 2% for the last six months, mainly because food inflation has cooled sharply.

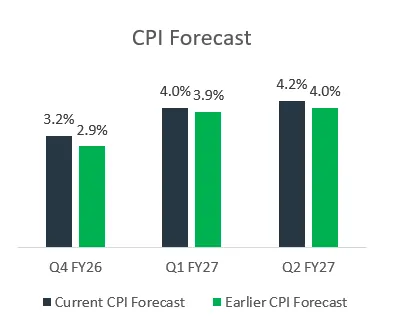

Even so, RBI nudged its inflation projections upward. The change is small, but the signal matters.

| Period | Latest RBI forecast | Earlier forecast | What changed |

|---|---|---|---|

| FY26 CPI | 2.1% | 2.0% | Slight upward revision |

| Q4 FY26 CPI | 3.2% | 2.9% | Bigger nudge up |

| Q1 FY27 CPI | 4.0% | 3.9% | Up marginally |

| Q2 FY27 CPI | 4.2% | 4.0% | Up marginally |

Takeaway: RBI is not treating the recent sub-2% inflation trend as something that will last on its own.

Governor Sanjay Malhotra noted that core inflation (excluding volatile items such as precious metals) is expected to remain range-bound.

This matters because it suggests RBI is not seeing a fresh, broad-based inflation problem yet. At the same time, it is also not in a hurry to cut again just because headline CPI has been low recently.

India is preparing to shift the base year for GDP, CPI, and IIP from 2011–12 to 2024. The new series is expected to be rolled out soon

Why you should care: a base-year change can alter what the inflation number looks like, even if underlying price dynamics do not change dramatically.

What economists are cautioning

So if CPI prints trend higher from here, part of it could be a measurement shift, not just a sudden jump in real-world prices.

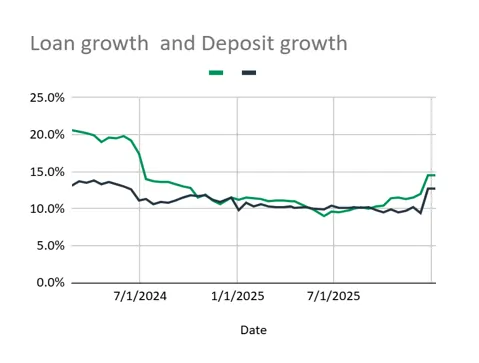

Liquidity remains in surplus.

RBI did not announce fresh OMO steps in this meeting. The broader message is that it wants earlier rate cuts to transmit fully, while staying ready to keep liquidity comfortable.

India’s forex reserves are around USD 723.8 billion, supported by steady capital flows.

In practical terms, strong reserves usually act as a cushion during global risk events and help reduce stress in domestic financial conditions.

Since repo is unchanged, immediate rate relief is less likely. The bigger story is still the transmission of the earlier 125 bps easing into lending rates over time.

A pause often helps deposit rates stay supported for longer. If inflation optics firm up, banks may not rush to cut deposit rates.

Overall, the policy outcome looks broadly neutral for banks and NBFCs. Liquidity remains supportive, even without new OMO announcements.

An MPC pause is not a signal to change long-term plans overnight. If anything, it is a reminder to keep portfolios aligned to goals and risk appetite, not policy-day headlines.

RBI held the repo rate at 5.25% after a cumulative 125 bps cut since Feb 2025. The decision was unanimous, and RBI signalled a pause to let past cuts transmit while it tracks inflation risks.

After the Feb 2026 MPC, SDF is 5.00% and MSF/Bank Rate is 5.50%, while repo remains 5.25%.

Because RBI is not assuming the recent low inflation will automatically persist. It slightly raised its forward inflation projections and is also watching how upcoming CPI series changes could affect reported prints.

It means the reference year used to calculate CPI weights and comparisons is being updated from 2011–12 to 2024. This can change the reported inflation rate due to updated consumption baskets and weights.

Yes. Economists caution the new CPI series may have an upward bias of 20–40 bps due to higher weights for core items and newer categories like e-commerce and OTT services.

Surplus liquidity generally supports easier financial conditions and helps past policy moves transmit. RBI has indicated it will act proactively to keep liquidity adequate.

Disclaimer: This article is for general information and educational purposes only. It does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Any references to companies or financial figures are for discussion and understanding of business models and reported results. Please consider consulting a qualified professional before taking any financial decision.

Finnovate is a SEBI-registered financial planning firm that helps professionals bring structure and purpose to their money. Over 3,500+ families have trusted our disciplined process to plan their goals - safely, surely, and swiftly.

Our team constantly tracks market trends, policy changes, and investment opportunities like the ones featured in this Weekly Capsule - to help you make informed, confident financial decisions.

Learn more about our approach and how we work with you:

Popular now

Learn how to easily download your NSDL CAS Statement in PDF format with our step-by-step g...

Explore what Specialised Investment Funds (SIFs) are, their benefits, taxation, minimum in...

Learn How to Download Your CDSL CAS Statement with our step-by-step guide. Easy instructio...

Looking for the best financial freedom books? Here’s a handpicked 2026 reading list with...