EPF vs PPF: Which Is Better for Retirement in India

EPF or PPF, which is better? Use this India guide with a quick comparison table, tax notes...

If you’re a salaried corporate professional, chances are retirement planning starts with one question: EPF, PPF, or NPS? The honest answer is that these are not competing “products”. They are three different tools with three different jobs.

This guide keeps it simple. You’ll get (1) a one-table comparison, (2) what each scheme is best used for, and (3) how most people end up combining them.

| Feature | EPF | PPF | NPS |

|---|---|---|---|

| Best for | Salaried employees building a base | Long-term stability you control | Market-linked retirement bucket |

| How money goes in | Payroll-driven (mandatory for many) | Voluntary, flexible | Voluntary (and can be employer-supported via corporate NPS) |

| Returns style | Declared rate by EPFO | Declared rate by Govt | Market-linked (depends on asset mix) |

| Current rate | 8.25% for FY 2024–25 | 7.1% for Jan–Mar 2026 quarter | No fixed rate (market-linked) |

| Risk level | Low to moderate | Low | Moderate (varies by equity allocation) |

| Liquidity | Rules-based withdrawals, retirement-focused | Long-tenure by design, limited access | Retirement-focused, withdrawals governed by NPS rules |

| Tax buckets (high level) | 80C (as applicable) | 80C | 80C + 80CCD(1B) and 80CCD(2) in employer cases |

| Exit structure | Retirement-linked withdrawal rules | Maturity/extension structure | Exit rules: non-govt subscribers can withdraw up to 80% lump sum and at least 20% annuity in many cases |

| Best role in plan | Forced discipline base | Stable long-term bucket | Growth layer + retirement architecture |

| Biggest mistake | Treating it as “liquid” money | Using it for short goals | Entering without understanding exit/annuity rules |

Note: In 2026, the New Tax Regime is the default. If you haven't opted out, remember that only Section 80CCD(2) (Employer NPS) offers a tax break. The popular ₹1.5L (80C) and ₹50k (80CCD-1B) benefits are strictly restricted to the Old Tax Regime.

Think roles, not labels.

EPF works because it’s boring and automatic. It pulls money out before you can spend it. For salaried people, that single feature is often the reason they retire with a meaningful base corpus.

EPF interest is a declared rate. For FY 2024–25, EPFO declared 8.25%. Over the last few years, EPF has generally stayed higher than PPF, but you should still treat it as “declared, can change”.

Also note one nuance: the employer contribution exists, but in many cases it is split between EPF and EPS (pension), so don’t assume the entire employer share always builds your EPF balance.

If you want a deeper EPF vs PPF-only breakdown, read this full guide: EPF vs PPF comparison (full guide)

PPF is one of the cleanest long-term stability buckets available in India because it is voluntary and simple. You choose how much to put in each year, and you don’t have to time anything.

PPF rate is declared by the Government and reviewed periodically. For the Jan–Mar 2026 quarter, PPF is 7.1%. This rate has remained unchanged for multiple recent quarters, which is useful if you want predictability.

NPS is built for retirement and can include equity exposure, which matters because retirement is often a 20–30 year timeline. Unlike EPF and PPF, NPS is market-linked, so outcomes depend on allocation and market cycles.

For corporate professionals, NPS becomes relevant for two reasons:

NPS is not “bad” because it has rules. It is simply a product where you accept the exit structure.

Takeaway: NPS is more flexible than it used to be, but it is still a retirement product with a defined exit framework.

These are helpful, but they should not be the only reason you choose NPS.

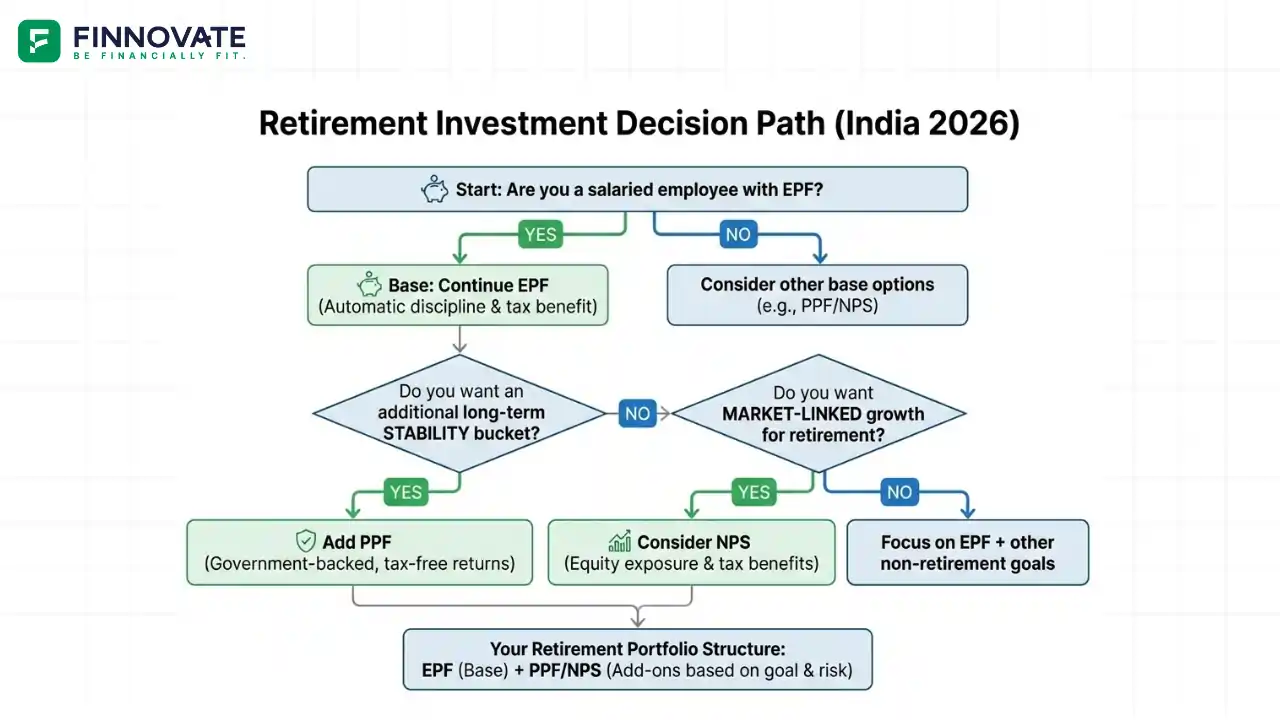

Use this as a quick filter.

These are common patterns, not one-size-fits-all recommendations. Your goal timelines still matter.

Best for people who want predictability and dislike market swings.

Best when you want balance between declared-rate comfort and market-linked potential.

Best suited for long timelines and higher comfort with volatility, because NPS outcomes will move with markets.

Book a retirement planning call with Finnovate and we’ll map your EPF/PPF/NPS into one clear plan based on your timeline, cash flows, and goals.

EPF, PPF, and NPS work best when each is used for the job it was designed for. EPF builds the base through discipline, PPF adds controlled stability, and NPS can add market-linked retirement growth with a defined rulebook.

There isn’t a single “best”. EPF works as a salaried base, PPF works as controlled stability, and NPS works as a market-linked retirement layer with defined exit rules.

Yes, many salaried professionals end up using EPF plus either PPF, NPS, or both depending on goals and comfort.

It can be useful for long-horizon retirement planning because it’s market-linked and retirement-focused. But you should understand the exit framework before committing.

Under the updated exit framework for many non-government subscribers, at exit it can be up to 80% lump sum and at least 20% annuity, and in certain cases 100% lump sum can be permitted based on corpus thresholds.

No. Both are declared rates that can change over time. For context, EPF was 8.25% for FY 2024–25 and PPF was 7.1% for the Jan–Mar 2026 quarter.

Usually: keep EPF running as the base, then decide whether you want an additional stability bucket (PPF) and whether you want a market-linked retirement layer (NPS).

No. Salaried people also use PPF as an extra long-term stability bucket beyond EPF.

No. These are retirement-oriented buckets. Keep a separate emergency fund for short-notice needs.

Disclaimer: This article is for educational purposes only. Interest rates, tax provisions, and withdrawal rules are subject to change as per notifications and applicable rules. Investing in securities markets is subject to market risks. Please read all scheme-related documents carefully. Registration granted by SEBI and certification from NISM in no way guarantee performance of the intermediary or provide any assurance of returns to investors.

Finnovate is a SEBI-registered financial planning firm that helps professionals bring structure and purpose to their money. Over 3,500+ families have trusted our disciplined process to plan their goals - safely, surely, and swiftly.

Our team constantly tracks market trends, policy changes, and investment opportunities like the ones featured in this Weekly Capsule - to help you make informed, confident financial decisions.

Learn more about our approach and how we work with you:

Popular now

Learn how to easily download your NSDL CAS Statement in PDF format with our step-by-step g...

Explore what Specialised Investment Funds (SIFs) are, their benefits, taxation, minimum in...

Learn How to Download Your CDSL CAS Statement with our step-by-step guide. Easy instructio...

Looking for the best financial freedom books? Here’s a handpicked 2026 reading list with...