Russian Oil Imports: Why India Is Cutting Exposure

India is reducing Russian oil imports as discounts shrink and sanctions raise payment risk...

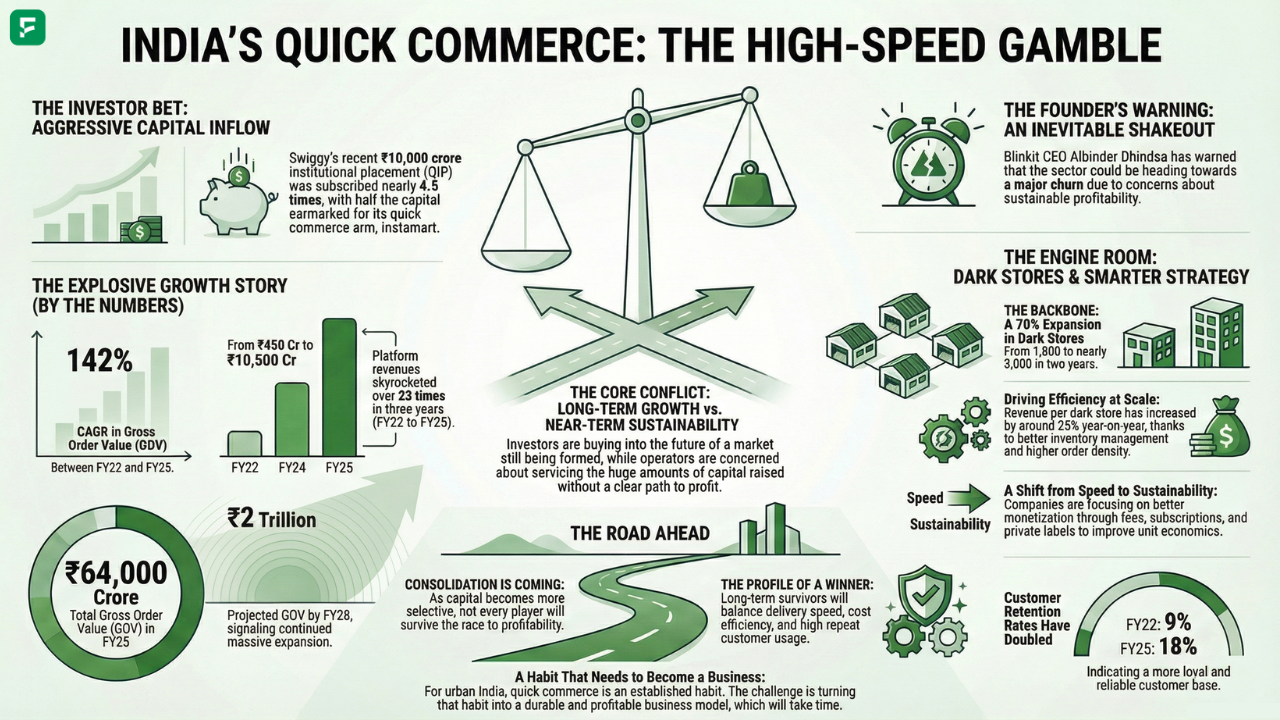

Over the last few weeks, India’s quick commerce story has thrown up two completely opposite signals.

On one hand, Blinkit CEO Albinder Dhindsa warned that the sector could be heading towards a major churn. On the other, Swiggy’s recent ₹10,000 crore QIP was subscribed nearly 4.5 times by institutional investors.

If capital is still chasing quick commerce so aggressively, why are industry leaders warning of a shakeout? The answer lies somewhere in between.

Last week, Swiggy raised ₹10,000 crore through a qualified institutional placement (QIP). The issue saw participation from FPIs, domestic mutual funds, and family offices, indicating strong institutional appetite.

A key detail stood out. Nearly half of the capital raised is expected to be deployed into quick commerce, primarily to scale Instamart.

The pricing carried a modest 4% discount to the floor price, but that wasn’t the real attraction. Investors were buying into the long-term potential of quick commerce - a small but rapidly expanding segment within India’s broader ecommerce landscape.

In simple terms, large pools of capital are trying to secure a meaningful share of a market that is still forming.

Albinder Dhindsa’s caution carries weight. Blinkit is currently the largest quick commerce platform in India, and his warning was blunt.

According to him, quick commerce companies have raised capital aggressively, but there is still limited visibility on:

The concern is not about growth, but about sustainability. If fundamentals do not improve, investor sentiment can swing rapidly - from enthusiasm to scepticism.

History shows that capital-intensive sectors often go through phases of consolidation once funding becomes more selective.

Despite scepticism, the growth trajectory of quick commerce in India has been striking.

What was once a side offering has now become a central pillar of ecommerce in urban India.

The drivers are clear: instant gratification, high population density, private labels, and deeper brand partnerships.

Behind the app experience lies the real engine of quick commerce - dark stores.

In just two years, the number of dark stores expanded by 70%, from 1,800 to nearly 3,000.

Scale has brought efficiency. Revenue per dark store has risen by around 25% year-on-year, reflecting better inventory management, higher order density, and round-the-clock optimisation.

The focus is gradually shifting from adding more locations to extracting better economics from existing ones.

One of the most important changes in quick commerce is not visible at first glance.

Retention rates have doubled from 9% in FY22 to 18% in FY25. Fee-based revenues have grown nearly 20-fold in three years and are expected to grow another four times over the next three years.

This indicates a move beyond speed-led growth towards better monetisation. Delivery fees, subscriptions, and private labels are slowly improving unit economics.

Profits may still be some distance away, but the direction of travel is becoming clearer.

Quick commerce in India is unlikely to deliver instant profitability. Capital will remain available, but it will be more selective. Not every player will survive.

The sector is likely to consolidate, with long-term winners being those who balance delivery speed, cost efficiency, and repeat usage.

For young, urban, time-constrained India, quick commerce has already become a habit. Turning that habit into a durable, profitable business will take time.

Disclaimer: This article is for informational and educational purposes only and does not constitute investment advice.

Finnovate is a SEBI-registered financial planning firm that helps professionals bring structure and purpose to their money. Over 3,500+ families have trusted our disciplined process to plan their goals - safely, surely, and swiftly.

Our team constantly tracks market trends, policy changes, and investment opportunities like the ones featured in this Weekly Capsule - to help you make informed, confident financial decisions.

Learn more about our approach and how we work with you:

Popular now

Learn how to easily download your NSDL CAS Statement in PDF format with our step-by-step g...

Explore what Specialised Investment Funds (SIFs) are, their benefits, taxation, minimum in...

Looking for the best financial freedom books? Here’s a handpicked 2026 reading list with...

Learn How to Download Your CDSL CAS Statement with our step-by-step guide. Easy instructio...