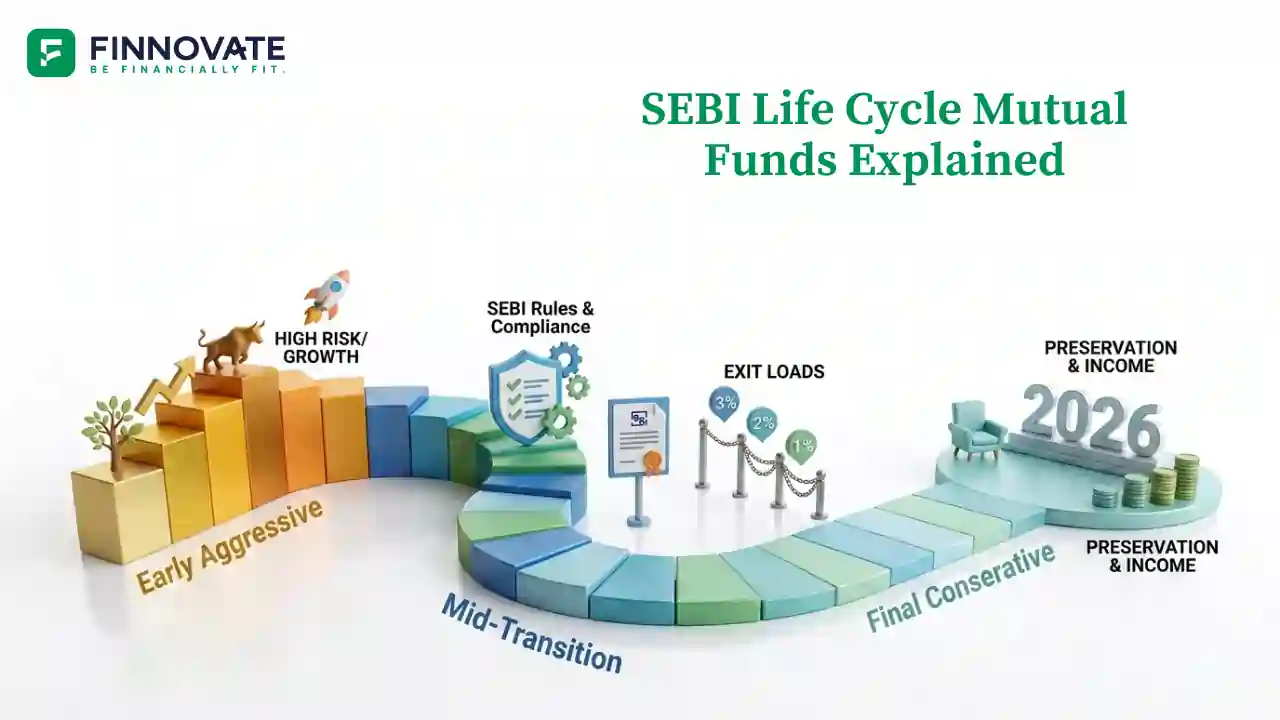

SEBI's New Life Cycle Mutual Funds Explained: Rules, Exit Loads, Glide Path (2026)

SEBI introduced Life Cycle Funds and discontinued solution-oriented schemes in Feb 2026. L...

December mutual fund flow data points to an important shift underway in investor behaviour. While market discussions often focus on returns or short-term volatility, fund flow trends usually tell a deeper story. The latest data suggests that investors are gradually moving away from purely active strategies and increasing their allocation to passive funds.

This shift is not abrupt, but it is becoming more visible. More importantly, passive investing this time is not limited to equity indices. It is increasingly being used as a tool for multi-asset allocation.

At an aggregate level, mutual fund flows in December 2025 were negative. This, however, is not unusual. Quarter-end outflows from debt funds are common as investors withdraw money to meet tax-related requirements.

Looking beyond headline numbers reveals a more meaningful trend.

This near parity between active and passive inflows is significant. Historically, active equity funds have dominated monthly inflow figures. December’s data suggests that investor preferences are becoming more balanced.

Breaking down passive fund inflows provides further insight into where investor money is moving.

Out of the ₹26,723 crore that flowed into passive funds:

This split is telling. While equity index investing remains important, the stronger flows into precious metal ETFs indicate that investors are using passive products for diversification rather than just equity market participation.

Some reasons for increased passive investing are well known and have existed for years.

When markets become volatile or when generating consistent alpha becomes difficult, investors often reassess the value of active management. Passive funds become more attractive in such phases, especially when:

Performance trends in 2025 have reinforced this thinking.

Passive funds, especially ETFs, allow investors to participate directly in such asset price movements without manager discretion or higher costs.

Cost is another important factor. As return expectations moderate, expense ratios play a bigger role in net outcomes. Passive funds, by design, keep costs low, which becomes more valuable in such environments.

While traditional factors explain part of the shift, they do not fully capture what is happening.

The more structural change is the growing preference for multi-asset allocation.

Investors today are no longer satisfied with portfolios limited to equity and debt, with occasional exposure to gold. There is a clear move toward more balanced and diversified portfolios that include multiple asset classes in a systematic manner.

Hybrid fund flows in December 2025 provide an important clue.

This concentration indicates that investors are consciously choosing products that offer exposure across assets rather than relying on ad-hoc diversification.

Passive products are increasingly seen as efficient building blocks for multi-asset portfolios.

They offer exposure across a wide range of assets through simple structures:

For investors looking to adopt a multi-asset approach, passive funds offer several advantages:

These features make passive funds particularly suitable for long-term asset allocation rather than short-term tactical moves.

The December flow data should not be viewed as a one-off monthly anomaly. Instead, it reflects an evolving investor mindset.

Investors appear to be:

This does not imply the end of active investing. Active funds will continue to play a role, especially in specific segments and strategies. However, passive funds are increasingly becoming the preferred choice for building diversified, cost-efficient portfolios.

Disclaimer: This article is for general information and educational purposes only. It does not constitute investment advice, a recommendation, or an offer to buy or sell any securities or mutual fund schemes. Mutual fund investments are subject to market risks. Please read all scheme-related documents carefully and consider consulting a qualified professional before taking any financial decision.

Finnovate is a SEBI-registered financial planning firm that helps professionals bring structure and purpose to their money. Over 3,500+ families have trusted our disciplined process to plan their goals - safely, surely, and swiftly.

Our team constantly tracks market trends, policy changes, and investment opportunities like the ones featured in this Weekly Capsule - to help you make informed, confident financial decisions.

Learn more about our approach and how we work with you:

Popular now

Learn how to easily download your NSDL CAS Statement in PDF format with our step-by-step g...

Explore what Specialised Investment Funds (SIFs) are, their benefits, taxation, minimum in...

Learn How to Download Your CDSL CAS Statement with our step-by-step guide. Easy instructio...

Looking for the best financial freedom books? Here’s a handpicked 2026 reading list with...