Omnitech Engineering IPO Review 2026: Business Model, Financials, GMP, Valuations, Risks & Key Facts

Omnitech Engineering IPO review 2026: issue size, price band, lot size, order book, busine...

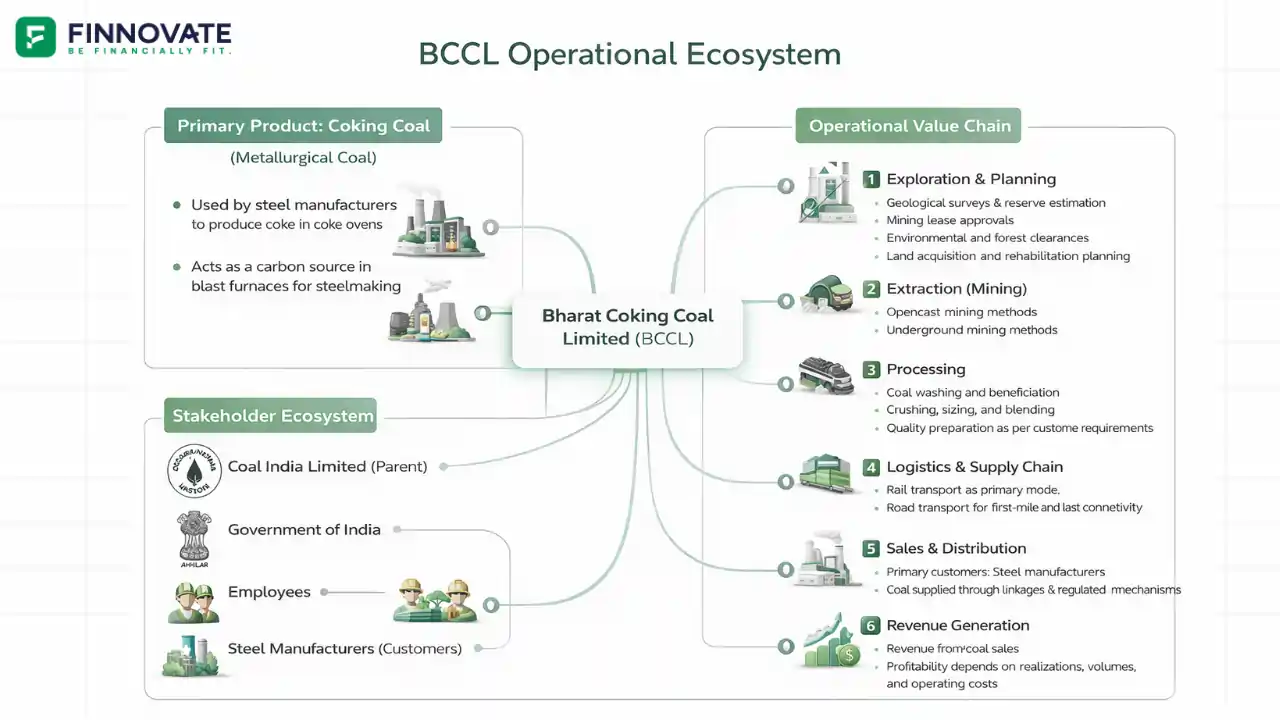

The 2026 IPO season heats up with a gritty, essential offering: Bharat Coking Coal Limited (BCCL), India's dominant producer of the coking coal indispensable for steel manufacturing.

As a major supplier of coking coal in India, BCCL plays a critical role in the steel value chain. At the same time, this IPO is a 100% Offer for Sale, which means the company does not receive fresh capital from the issue. That makes it important to evaluate BCCL based on its existing operations, cash flows, and cycle-linked risks rather than future expansion narratives.

This review looks at the business model, financial performance, and key risks to help investors assess whether a commodity-driven, policy-influenced business like BCCL fits their long-term portfolio approach.

| Company Name | Bharat Coking Coal Limited (BCCL) |

| Issue Type | Bookbuilding IPO |

| IPO Type | Offer for Sale (OFS) |

| Promoter | Coal India Limited |

| Issue Size | 46.57 crore shares |

| Issue Amount | ~₹1,071 Cr |

| Face Value | ₹10 per share |

| Price Band | ₹21 to ₹23 |

| Lot Size | 600 shares |

| Listing Exchanges | BSE, NSE |

| IPO Opens | Friday, Jan 9, 2026 |

| IPO Closes | Tuesday, Jan 13, 2026 |

| Listing Date (Tentative) | Friday, Jan 16, 2026 |

| Market Cap (Pre-IPO) | ₹10,711.10 Cr |

| Employee Discount | ₹1 per share |

Key clarity:

This is a 100% Offer for Sale. BCCL will not receive any money from this IPO.

| Stock / IPO | IPO GMP | IPO Price | Indicative Listing Gain* |

|---|---|---|---|

| Bharat Coking Coal (BCCL) | ₹11 | ₹23 | ~47.83% |

*Note: GMP is an unofficial indicator and reflects short-term demand and trading sentiment. It does not reflect business quality or long-term return potential, especially for PSU and commodity companies.

| IPO Opens | Fri, Jan 9, 2026 |

| IPO Closes | Tue, Jan 13, 2026 |

| Allotment | Wed, Jan 14, 2026 |

| Refunds | Thu, Jan 15, 2026 |

| Credit of Shares | Thu, Jan 15, 2026 |

| Listing | Fri, Jan 16, 2026 |

BCCL was incorporated in 1972 and operates as a subsidiary of Coal India Limited. It is India’s largest producer of coking coal, operating primarily in:

Its coal output is mainly supplied to the steel industry, with limited exposure to other industrial users.

BCCL is a capital-intensive mining business.

| Aspect | What it means |

|---|---|

| Revenue source | Sale of coal |

| Customers | Primarily steel producers |

| Pricing power | Limited, policy-linked |

| Cost structure | High fixed and operating costs |

| Profit nature | Cyclical |

Profits are driven by:

This is not a business where profits grow smoothly year after year.

India plans significant expansion in steel capacity, which supports long-term demand for coking coal.

India’s steel capacity is targeted to reach around 300 million tonnes by 2030, which materially increases coking coal demand and creates a persistent supply gap due to domestic quality and reserve constraints.

As a result, India continues to rely on imports from countries like Australia, Canada, and the US, while also exploring new supply sources such as Mozambique and Mongolia, alongside efforts to increase domestic production.

Amount in ₹ Crore

| Period Ended | 30 Sep 2025 | 31 Mar 2025 | 31 Mar 2024 | 31 Mar 2023 |

|---|---|---|---|---|

| Total Income | 6,311.51 | 14,401.63 | 14,652.53 | 13,018.57 |

| EBITDA | 459.93 | 2,356.06 | 2,493.89 | 891.31 |

| Profit After Tax | 123.88 | 1,240.19 | 1,564.46 | 664.78 |

| Net Worth | 5,830.89 | 6,551.23 | 5,355.47 | 3,791.01 |

| Reserves & Surplus | 1,006.52 | 1,805.73 | 664.72 | (853.10) |

| Total Assets | 18,711.13 | 17,283.48 | 14,727.73 | 13,312.86 |

| Total Borrowings | 1,559.13 | – | – | – |

What stands out

| ROCE | 30.13% |

| RoNW | 20.83% |

| PAT Margin | 8.61% |

| EBITDA Margin | 16.36% |

| Price to Book | 1.63 |

These ratios look healthy but are influenced by the cycle.

| Particular | Pre-IPO | Post-IPO* |

|---|---|---|

| EPS (₹) | 2.66 | 0.53 |

| P/E (x) | 8.64 | 43.23 |

| Promoter Holding | 100% | 90% |

| Market Cap | ₹10,711.10 Cr | ₹10,711.10 Cr |

*Post-IPO EPS is based on post-issue shareholding and annualised earnings for the half-year ended Sep 30, 2025.

Mining operations in Jharia continue to face:

These limit rapid productivity improvement.

The BCCL IPO is a way to participate in a strategic but cyclical PSU mining business.

Long-term outcomes will depend on:

The right question remains:

Does a commodity PSU align with your long-term portfolio approach?

No. It is a 100% Offer for Sale.

Coal India Limited.

Steel demand, coal quality, mining efficiency, and policy factors.

GMP reflects sentiment only.

Disclaimer:

This article is for educational and informational purposes only. It does not constitute investment advice, a recommendation, or an offer to buy or sell any securities. Investors should read the Red Herring Prospectus and final offer documents carefully and consult a registered financial adviser before making any investment decision.

Finnovate is a SEBI-registered financial planning firm that helps professionals bring structure and purpose to their money. Over 3,500+ families have trusted our disciplined process to plan their goals - safely, surely, and swiftly.

Our team constantly tracks market trends, policy changes, and investment opportunities like the ones featured in this Weekly Capsule - to help you make informed, confident financial decisions.

Learn more about our approach and how we work with you:

Popular now

Learn how to easily download your NSDL CAS Statement in PDF format with our step-by-step g...

Explore what Specialised Investment Funds (SIFs) are, their benefits, taxation, minimum in...

Learn How to Download Your CDSL CAS Statement with our step-by-step guide. Easy instructio...

Looking for the best financial freedom books? Here’s a handpicked 2026 reading list with...