EPF vs. PPF vs. NPS: Which is better for Retirement in India

EPF vs PPF vs NPS explained simply for India (2026). Compare returns type, tax buckets, lo...

If you’re 40 and still wondering “Have I done enough for retirement?” - you’re not alone. In India, most people delay retirement planning until their 40s because of career priorities, family responsibilities, or lack of awareness.

The good news? Even if you missed the early compounding years, you still have 15–20 strong earning years ahead. With the right strategy, you can build a solid retirement corpus. Let’s see how late start retirement planning in India can still secure your golden years.

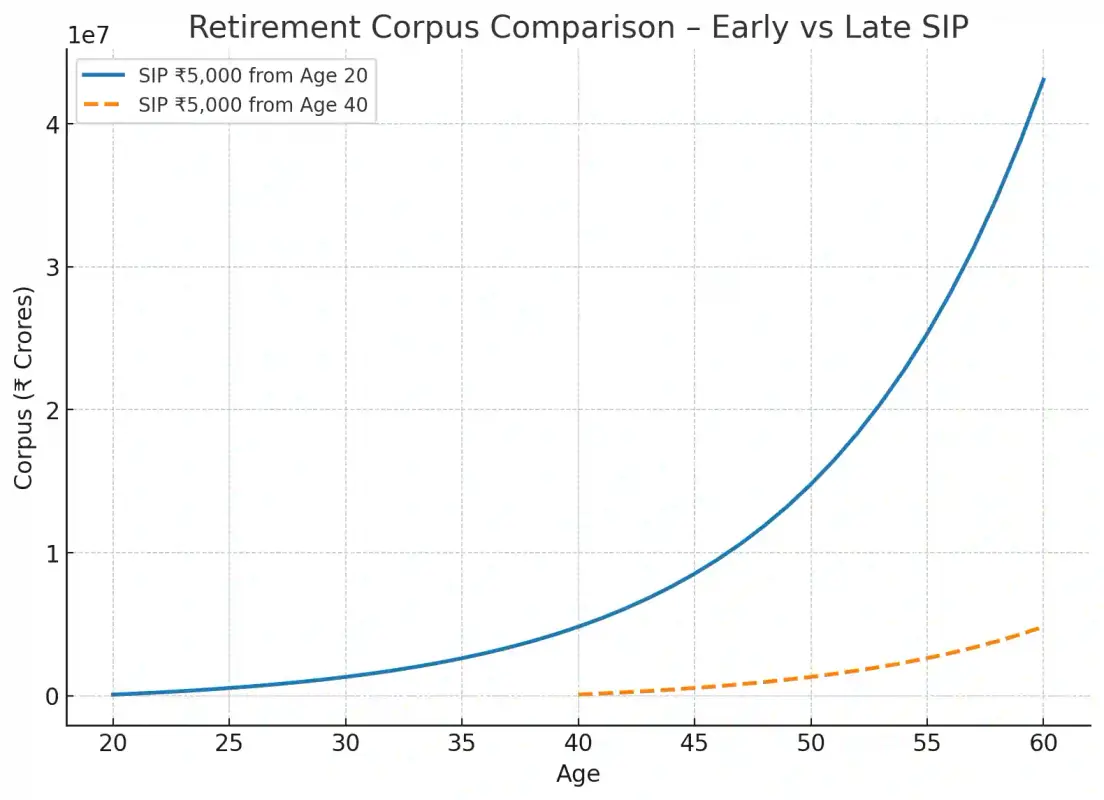

Early starters get the magical power of compounding. But what happens when you start late?

Even doubling SIP to ₹10,000/month at 40 gives only ₹69 lakh in 20 years. To reach the same ₹3.9 crore corpus, you’d need nearly ₹56,000/month SIP for 20 years.

Lesson: Time is the biggest wealth builder. But late starters can still catch up with smarter strategies.

When starting at 40, you must balance realistic goals with aggressive saving.

Tip: Focus on inflation-adjusted targets. For example, ₹1 crore today will be worth only about ₹32 lakh in 20 years at 6% inflation.

Don’t overestimate returns - assume 10–12% CAGR for equity-heavy portfolios.

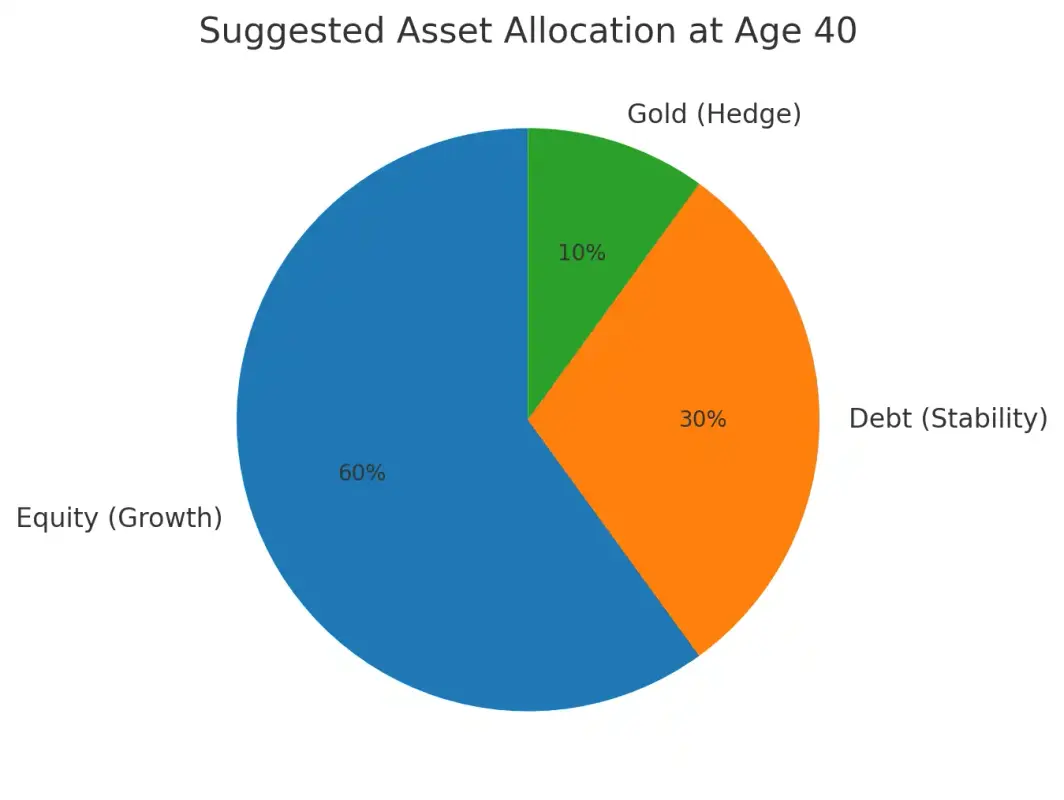

When you’re 40, you can’t afford reckless risk. Balance growth with stability:

Example allocation at age 40: 60% Equity | 30% Debt | 10% Gold.

High-interest loans are retirement killers.

Example: Redirecting a ₹25,000 EMI into SIP at 11% CAGR → ₹1.6 crore in 20 years.

Your retirement plan can collapse without protection.

Remember: It’s post-tax return that matters, not just gross return.

With just 15–20 years left, mistakes can cost you crores.

When time is short, experience is worth more than trial-and-error DIY.

Yes, but only if you’re aggressive.

Caveat: Works only for high-income earners with controlled lifestyle.

Starting at 40 is not ideal, but it’s far from hopeless.

With discipline, you can still secure financial independence and enjoy a stress-free retirement.

Want to know how much you need to invest monthly?

Use our Retirement Calculator and schedule a free call with our advisor today.

Yes, but it requires extreme discipline, high savings rate (50–60% of income), and equity-heavy portfolio. For most people, retiring at 60 is more practical.

For a ₹5–6 crore corpus by 60, you’d need ₹40,000–₹50,000/month SIP at ~11% CAGR.

Yes. NPS offers equity + debt mix, additional ₹50,000 tax deduction, and is suitable for disciplined long-term saving.

For metro middle-class lifestyle, ₹5–6 crore is a realistic target by 60, considering inflation and healthcare.

SIP ensures discipline and rupee-cost averaging. But if you get a lumpsum (bonus, property sale), investing part immediately into a diversified portfolio accelerates catch-up.

Disclaimer: This article is for educational purposes only. Examples use assumed returns/inflation and are illustrative; investments are subject to market risks. Please consult a SEBI-registered investment adviser/tax professional before acting.

Popular now

Learn how to easily download your NSDL CAS Statement in PDF format with our step-by-step g...

Explore what Specialised Investment Funds (SIFs) are, their benefits, taxation, minimum in...

Looking for the best financial freedom books? Here’s a handpicked 2026 reading list with...

Learn How to Download Your CDSL CAS Statement with our step-by-step guide. Easy instructio...