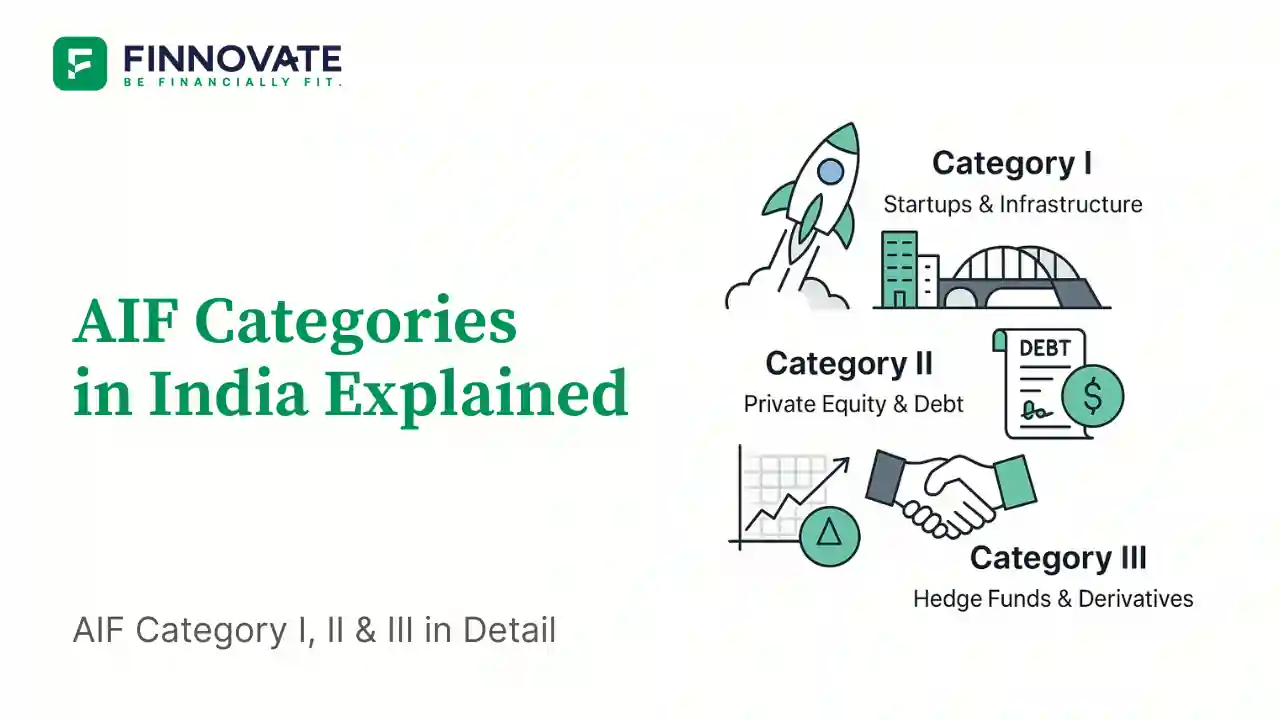

Why Understanding AIF Categories Matters?

Alternative Investment Funds (AIFs) are not a one-size-fits-all product. The Securities and Exchange Board of India (SEBI) has divided AIFs into three categories to help investors - especially High Net Worth Individuals (HNIs) - choose funds that match their goals, return expectations, and risk appetite.

If you read our Beginner’s Guide to AIFs, you know these are privately pooled vehicles designed for sophisticated investors. What you may not know is that each category uses a very different approach:

- Some support early‑stage businesses and infrastructure (lower liquidity, potentially high impact).

- Others focus on structured debt or private equity for steadier returns.

- Some deploy complex trading strategies aiming for high - but more volatile - returns.

Knowing the difference is crucial because your choice will affect your investment horizon, taxation, and overall portfolio behaviour.

Category I AIFs

Definition

Category I AIFs invest in areas SEBI views as socially or economically desirable such as start‑ups, early‑stage ventures, SMEs, social ventures, and infrastructure projects.

Purpose & focus areas

- Promote economic growth and job creation.

- Channel capital into under‑served but high‑potential areas.

Who usually invests

- Investors seeking long‑term growth and willing to accept illiquidity.

- HNIs or institutions with higher risk appetite for early‑stage companies.

Typical strategies

- Venture Capital Funds - early‑stage start‑ups.

- SME Funds – growth capital for small and medium enterprises.

- Infrastructure Funds - long‑gestation infra projects.

- Social Venture Funds - impact‑focused investments.

Risk & return profile

- Risk: High (early‑stage exposure, low liquidity).

- Returns: Can be substantial if ventures succeed; typically the longest gestation among AIF categories.

Regulatory highlights

- SEBI encourages Category I via policy support and compliance ease.

- Minimum investment: ₹1 crore (₹25 lakh for employees/directors of the fund).

Category II AIFs

Definition

Category II AIFs include funds not classified as Category I or III and that do not use leverage (except for temporary needs). They typically invest in private equity, debt, and structured credit to target stable, medium‑to‑high returns over the medium to long term.

Purpose & focus areas

- Provide capital for business expansion, buyouts, or debt restructuring.

- Aim for predictable cash flows with lower volatility than early‑stage ventures.

Who usually invests

- Investors seeking steadier returns than Category III’s trading strategies.

- HNIs and institutions comfortable with 4–7 year lock‑ins.

Typical strategies

- Private Equity Funds – buyouts or growth capital for mature companies.

- Debt Funds – mezzanine financing, distressed debt, structured credit.

- Real Estate Funds – financing for residential or commercial development.

Risk & return profile

- Risk: Moderate to high (depends on business and credit quality).

- Returns: Potentially higher than traditional debt and more predictable than start‑up investing.

Regulatory highlights

- No sector‑specific mandate (unlike Category I).

- Minimum investment: ₹1 crore (₹25 lakh for employees/directors of the fund).

- Cannot raise funds through public issues (private placement only).

Category III AIFs

Definition

Category III AIFs are funds that employ diverse or complex trading strategies, often including leverage, to generate returns over shorter time frames. They can invest in listed or unlisted derivatives, debt, equity, and other securities, making them somewhat similar to hedge funds in their approach.

Purpose & focus areas

- Seek absolute returns regardless of market conditions.

- Use active trading, derivatives, and hedging strategies to exploit market opportunities.

Who usually invests

- Experienced investors who understand market volatility and are comfortable with high risk.

- HNIs looking to diversify beyond long-only strategies, often as a small allocation within a larger portfolio.

Typical strategies

- Long-Short Equity Funds – take both bullish and bearish positions.

- Market-Neutral Funds – aim to profit from price inefficiencies without directional bias.

- Arbitrage Funds – exploit pricing differences in markets or instruments.

Risk & return profile

- Risk: High (due to leverage, market volatility, and complex instruments).

- Returns: Potentially high but can fluctuate significantly; not ideal for investors seeking stability.

Regulatory highlights

- Allowed to use leverage within SEBI-specified limits.

- Higher compliance and disclosure requirements due to trading complexity.

- Minimum investment requirement: ₹1 crore (₹25 lakh for employees/directors of the fund).

Want to know how taxation works for different AIF categories? Read our AIF Taxation Guide →

Quick Comparison of AIF Categories in India

| Feature | Category I | Category II | Category III |

|---|---|---|---|

| Primary Focus | Start-ups, SMEs, social ventures, infrastructure | Private equity, debt, real estate | Hedge-fund-like strategies, derivatives, long-short equity |

| Risk Level | High | Moderate to High | High |

| Return Potential | High (long-term) | Moderate to High | High (short to medium-term) |

| Liquidity | Low (long lock-in) | Low to Medium | Medium to High (depending on strategy) |

| Minimum Investment | ₹1 crore (₹25 lakh for employees/directors) | ₹1 crore (₹25 lakh for employees/directors) | ₹1 crore (₹25 lakh for employees/directors) |

| Regulatory Restrictions | Encouraged by SEBI for economic development | No sector-specific mandate; no leverage (except temporary) | Can use leverage; stricter compliance requirements |

| Ideal For | Impact-focused long-term investors | Investors seeking steady medium-term returns | High-risk investors seeking absolute returns |

How to Decide Which AIF Category is Right for You

Choosing the right AIF category isn’t about picking the one with the highest returns - it’s about matching your goals, risk appetite, and liquidity needs with the fund’s strategy.

1. Define Your Objective

- Wealth Creation with Impact? Consider Category I (supports start-ups, infrastructure, SMEs).

- Steady, Predictable Growth? Category II may suit you better with private equity or debt focus.

- High-Risk, High-Reward Trading? Category III is designed for tactical, market-driven returns.

2. Understand Your Risk Tolerance

- If volatility makes you uncomfortable, avoid leveraged or speculative strategies (often in Category III).

- If you’re willing to lock money for years, Category I and II offer more structured, long-term bets.

3. Consider Liquidity Needs

- All AIFs have some lock-in, but Category III may allow quicker exits depending on the fund design.

- Avoid committing capital you might need urgently.

4. Look at Tax Treatment

- Tax rules differ by category and strategy - knowing the post-tax returns is as important as pre-tax performance.

- This is especially important for HNIs in the highest tax bracket.

5. Seek Professional Guidance

AIFs are complex, regulated investments - having an advisor review the fund structure, strategy, and fee model can save you from costly mistakes.

Tip: SEBI’s minimum investment requirement (₹1 crore) ensures only sophisticated investors participate - so treat this as a serious, long-term allocation, not an experiment.

Before choosing a category, make sure you understand how AIF taxation works - Read the complete AIF Taxation Guide →

Want to Explore Which AIF Fits Your Portfolio?

Book a call with our investment specialists to discuss your goals and see how AIFs could complement your existing plan. We'll help you cut through the jargon and focus on what truly matters - aligning your money with your objectives.