AIF Taxation in India: Rules, Rates, and Investor Guide (2026)

Learn how Alternative Investment Funds (AIFs) are taxed in India. Covers Category I, II, III rules, rates, TDS, and tips for resident & NRI investors.

Read FullArchive of all the blogs posted

Showing 3 articles this page

Learn how Alternative Investment Funds (AIFs) are taxed in India. Covers Category I, II, III rules, rates, TDS, and tips for resident & NRI investors.

Read Full

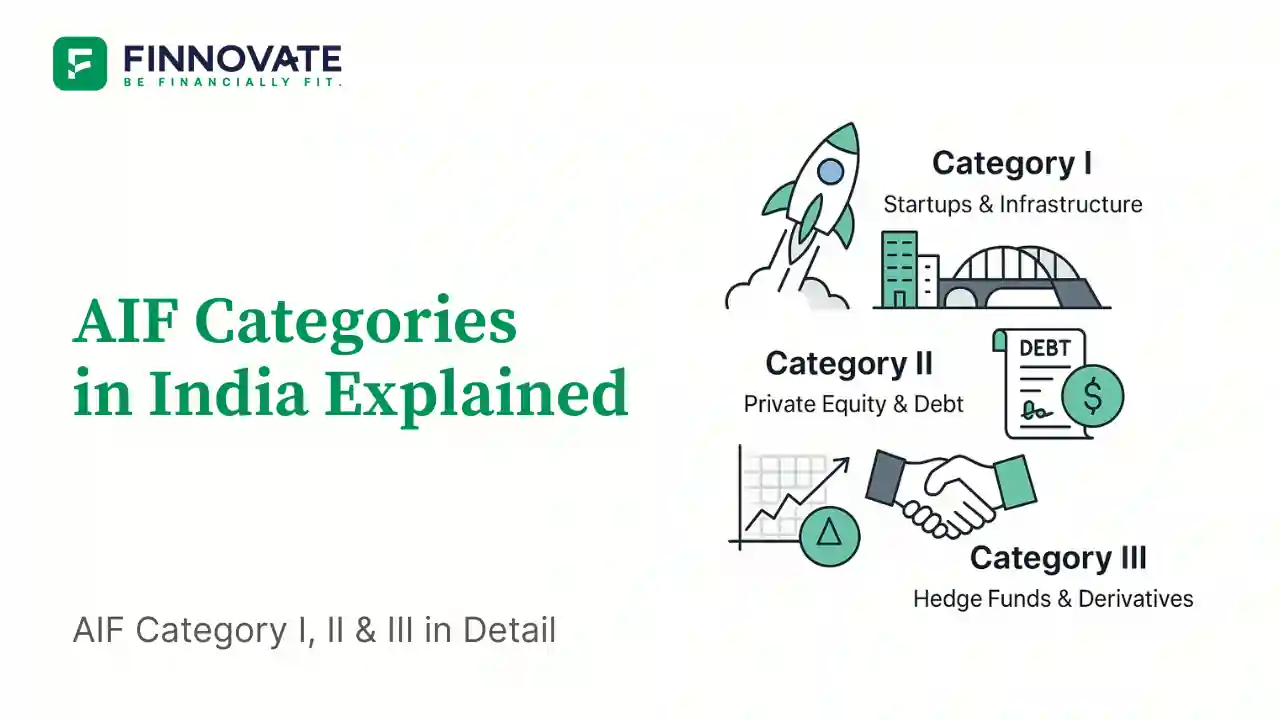

Learn about the three SEBI-approved AIF categories in India – Category I, II & III. Understand their purpose, risk, returns, and how to choose the right one for your portfolio.

Read Full

New to Alternative Investment Funds (AIFs)? Learn what they are, how they work, key types, eligibility, and pros & cons in this beginner’s guide for Indian investors.

Read Full